Nobody knows s%#t for sure !featured

Demonetization: All predictions about the future are at best educated guesses.

Are you totally confused by the flood of articles, FB posts and Whatsapp forwards on demonetization? You are not the only one. The issue is really complex and even the experts making predictions are guessing when they say what will happen in the future. Underlying their guesses are explicit and sometimes not so explicit assumptions. Big assumptions.

Let me explain with an example. It is slightly complex example but bear with me.

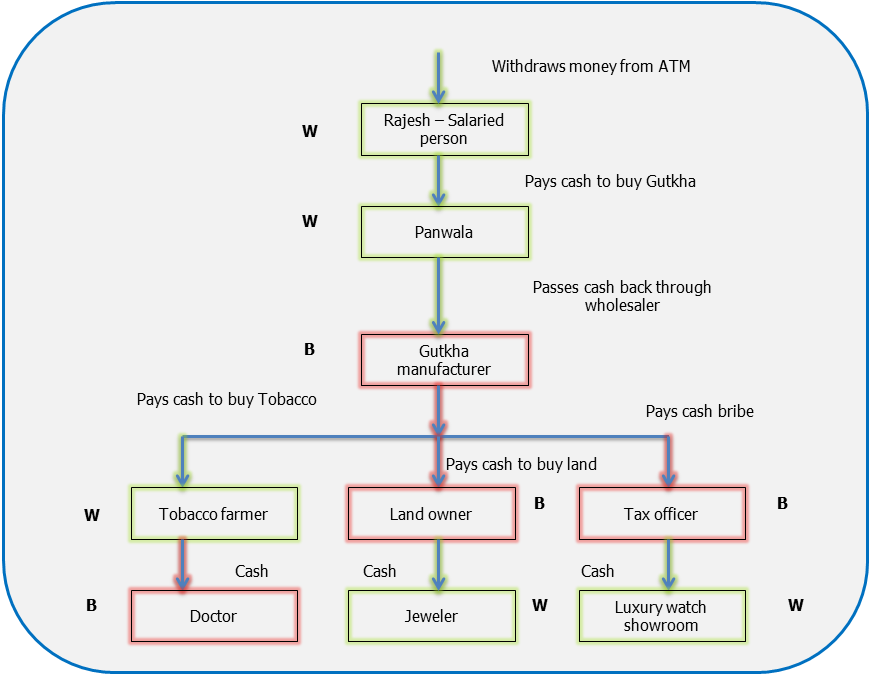

1. Rajesh is a salaried employee and his employer deposits his monthly income in the bank. So of course, this income is white. He withdraws some of the money from an ATM and buys a few packs of Gutkha from the local panwala.

2. The panwala passes on most of the money through a wholesaler to the manufacturer. The net income of the panwala is small and he is not liable to pay tax.

3. Unknown to the panwala, the manufacturer is not accounting for this money in his books to evade paying the considerable amount of taxes on Gutkha. Thus, the white money of Rajesh has now become Black.

4. The manufacturer has to share part of this black income with his distributors and retailers. He also keeps a small amount in cash for day to day business expenses.

5. With the remaining part of this black income the manufacturer bribes a government tax official, buys land (partly paid for by cheque) and also buys Tobacco from a farmer.

6. The cash in hands of the tax officer and the land seller is black and in hands of farmer white.

7. The tax officer buys a fancy watch and keeps the remaining amount in cash. The land seller buys jewelry for his daughter’s wedding with some part of the money and keeps the remaining money in cash. The farmer uses some part of the money he got to pay a Doctor his fees.

8. The Swiss watch showroom and the jeweler declare the cash sale making the money white again. The Doctor does not declare a portion of the income making it black.

The main point of this example is that cash moves through the economy in a very complex ways and that the black and white economies are strongly intertwined. When you squeeze the black economy you are squeezing the white economy too.

Also, note that this contrived example is a minuscule part of reality! There would be millions of Rajesh and hundreds of distributors. The manufacturer would have thousands of income and expense entries. And of course across the vast country there are many different types of businesses and even more number of individuals with great differences in incomes. Reality = 1 Billion x this example or maybe more.

When columnists (including this one) give their opinions on the impact of demonetization, it is a guess. Educated guess at best and personal bias at worst.

Let us look at some of the areas of prediction.

Will this measure reduce generation of Black Money in future?

In our example, it depends on how much money the manufacturer, the tax officer, the doctor and the land seller had in cash and the day of demonetization and how much they are able to convert to new notes using both official and unofficial channels. Their tax liability and penalty in case of official channels and the commission they end up paying if they use unofficial channels will be a factor in their future decisions.

How much will be the impact on future Black Money?

It depends on your assumptions.

Will this measure reduce GDP growth in the short term?

Definitely. The panwala will see a drop in sales because people do not have cash. He may make temporary arrangements to get gutkha on credit and sell it to his known customers on credit but he will still see drop in sales and would reduce his own purchases as much as he can. So would everyone in our example. There is no way of accurately knowing how much would this reduction would be.

How much would be the drop in demand and how long will it last?

Depends on your assumptions.

Will this measure impact GDP growth in the long term?

Yes, but this impact is even more difficult to assess. On one hand, the demand shortage and liquidity crunch could force small entrepreneurs to go out of business. On the other hand the government could use the extra tax collection to build social and physical infrastructure, which spurs the economy. There is also a likelihood of organized businesses growing to take place of the dying unorganized business. Additionally, future is not static and individuals, firms and governments will react to the given situation and make the situation worse or better.

How much will be the long-term impact on GDP?

You guessed it right; it depends on your assumptions.

In summary, demonetization is a very big move in a very very complex system viz. the Indian economy. Any prediction about the outcome, whether positive or negative, is at best an educated guess. I would think that even the government of India was guessing about the benefits and costs when it made the move.

Note 1: I have not spoken about the social costs of this move – people going hungry because they cannot get their daily employment for example. This is because I have no way of knowing about these except for anecdotes that I hear and read in media. This does not mean that the social costs are not real.

Note 2: There is nothing inherently wrong with the columnists guessing. It is just that we should not take any one’s view as absolute truth.

(Yogesh Upadhyaya is a founder of AskHow India. Blogs are personal views)